TAX PLANNING FOR GLOBAL COMPANIES

We help founders understand the tax implications for themselves and their companies when registering a new entity abroad. We do this by connecting founders to tax specialists situated around the globe.

Avoid taxation surprises when launching a company abroad

Founders might choose to register their company in a foreign jurisdiction due to regulatory uncertainty in their own jurisdiction or because the foreign jurisdiction is investment-friendly.

Regardless of the reason, registering a company abroad triggers many tax-related questions on matters like double taxation, share sales taxes, and CFC. We help global founders figure out the answers at the very beginning to avoid any surprises and connect them with the right tax specialists on our platform.

I don't have to worry about what legal tasks we need to deal with. I just come with business needs, and our Virtual Legal Officer transforms them into legal solutions that the lawyers start working on right away.

Tax questions to solve when registering a company abroad

When choosing a tax-friendly jurisdiction for your company...

Which are the top tax-friendly countries that work best for tech companies?

Which countries have a special tax regime for my type of tech company?

What are the tax obligations in the jurisdiction where I am considering registering my company?

While identifying all the company and personal tax implications...

What is the corporate income tax rate?

What is the withholding tax on dividends, shares sale and director's fee?

Is there a double taxation treaty between my tax residence country and the company country?

Will the place of effective management / permanent establishment / CFC rules apply?

While planning for future tax residence changes...

What will my tax obligations be if I move to another country?

If I change my residency status and move to a new country, will I have to pay taxes in my previous country of residence?

How will my change in residency status influence my foreign company and what might the tax implications be?

How Legal Nodes helps

Explore

Understand all your company registration & taxation options, from a global perspective.

Strategize

Pick from some of the best options with help from legal experts with international knowledge.

Achieve

Manage all your multi-jurisdictional tax and legal works in one place.

We've found Legal Nodes to be most useful for founders who face the complex task of creating legal frameworks for their international projects.

Figure out your tax implications when registering a new company or changing your residency, so that you can protect your personal and company interests.

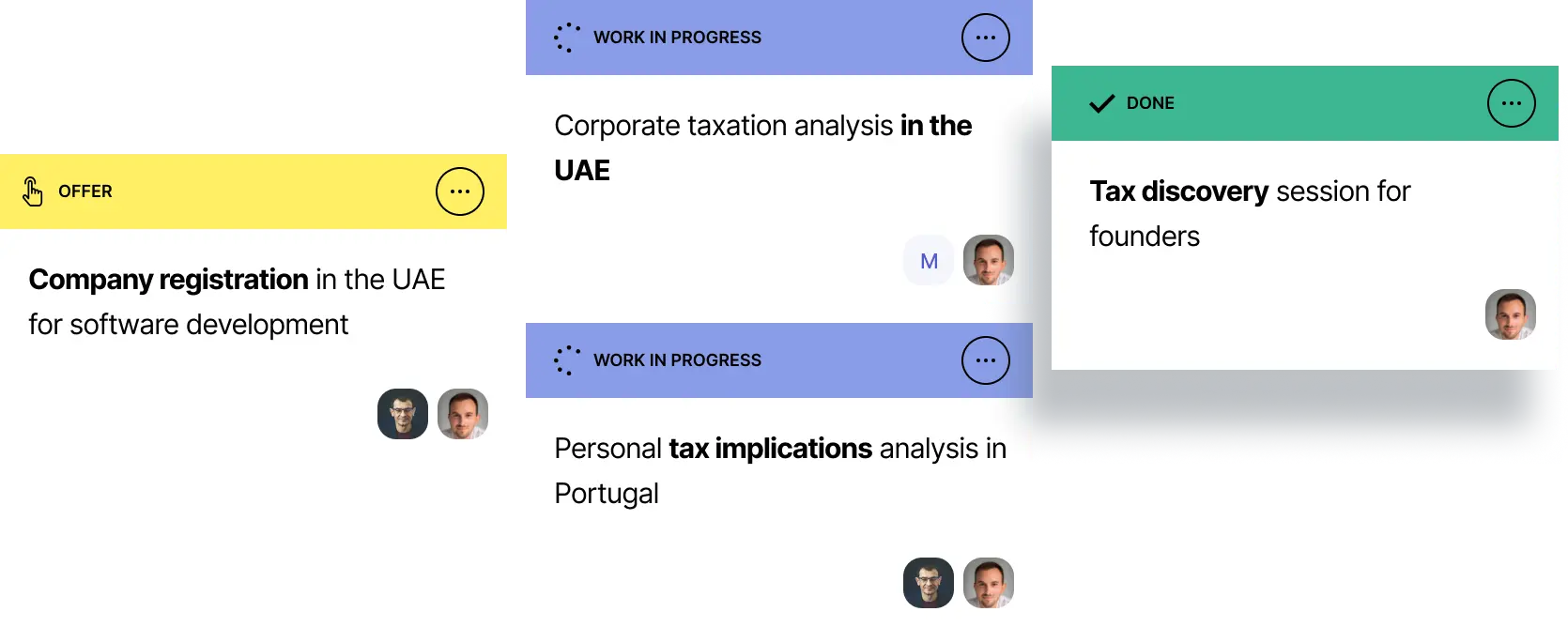

GET STARTEDHow we help with tax planning tasks

With the help of our international legal experts and a vast network of local, qualified tax specialists, we help founders figure out their most important global taxation matters when registering new companies or moving abroad.

View pricingGet to know the global tech-friendly tax regimes and learn which international taxation matters founders should keep in mind when registering a company abroad

Obtain a detailed tax analysis and calculation on the virtual assets transaction from a qualified local tax expert

Obtain a detailed tax analysis from a qualified local tax specialist based in the country where you plan to register your entity

Obtain a tax analysis on the tax consequences of moving from one country to another as a serial entrepreneur

Frequently asked questions

To determine which countries might be tax-friendly options for a specific tech business, founders will need to analyze several things including the company's business model, the founder's location, and other factors.Some of the most widely-recognized countries that have a friendly regulatory and tax climate for tech businesses include the United Kingdom, Switzerland, Cyprus, Estonia, Hong Kong, Singapore, and the United Arab Emirates.

The most important criteria that founders must take into consideration when analyzing the tax aspect of their decision to register their company in a foreign country are the rules and regulations that differ from jurisdiction to jurisdiction. This includes rules on:

- withholding tax on dividends

- Common Reporting Standard (CRS) and Foreign Account Tax Compliance Act (FATCA)

- taxation of director's fees

- Controlled Foreign Companies (CFC)

- Place of Effective Management (PoEM)

- Permanent Establishment (PE)

By checking to see if any of these rules will apply to the founder or business, founders can reduce the risk of receiving penalties and fines when registering their company in a foreign country. Additionally, they can prevent themselves from encountering future issues with transferring proceedings between banks and countries or facing any other serious consequences down the line.

There are several countries around the world that offer special tax regimes for tech businesses. These include the UK, Cyprus, Estonia, and Singapore.

- In Cyprus, the corporate tax rate is only 12.5%, and legislation offers a range of tax incentives, plus in some conditions, up to 80% of company income can be exempt from taxation.

- In Estonia, only ‘distributed profit’ is subject to taxation (of a basic rate of 20%), so only things like dividend payments and expenses that aren’t related to company activities are taxable.

- The UK offers two mechanisms to substantially reduce tax for tech businesses. The ‘patent box regime’ means that tax rates for activities related to patents are effectively only 10%. The ‘R&D tax relief’ scheme allows companies to deduct 86% of R&D costs per yearly profit, atop of the usual 100% deduction, resulting in a whopping 186% deduction, permitting businesses to nearly double their R&D expenses.

- Singapore offers a 17% tax rate with various tax exemption rules for new startups.

- Hong Kong offers a ‘double-tier’ approach whereby a tax rate of 8.5% is applicable until a certain profit threshold.

If you're planning to change your tax residence country while having a foreign company, you need to ask the following questions:

- Which countries have special regimes for digital nomads or entrepreneurs?

- What are your current tax obligations in your current country of residence?

- What will your future tax obligations be in the new country where you plan to move to?

By finding answers to these questions, you can protect yourself from any unwanted tax surprises and also plan your tax payments in advance, to ensure you always pay the right amount of tax once you decide to change your country of residence.

Get the latest insights on tax implications for global businesses

Get started with Legal Nodes

Plan your next business milestone with a clear understanding of all your tax obligations across the globe.