Welcome to this startup incorporation guide for startups and businesses thinking about registering their company in Delaware. This guide provides a step-by-step explanation of how to register a company in the USA, obtain all the necessary post-incorporation documents, and make sure you’ve covered everything that you need to know about in the process. Whether you plan to hire from external investors in the future, or simply want to avoid expensive fines for non-compliance, completing the process properly will make things a lot easier in the future.

This guide is detailed and we suggest that to get the maximum benefit from these resources you may wish to revisit the guide and review this material in stages. We’ve set out the information in four parts, and in an order that should be useful to you and easy to follow.

👉 Register an operating company

Checklist for founders registering their startup in Delaware

This checklist covers the main tasks that you and your team need to complete to ensure a successful company registration. It is divided into 2 stages: Incorporation and Post-Incorporation.

Incorporation:

- Create and approve your cap table for the future company and choose the:

- (i) size of the authorized capital of the company,

- (ii) classes of stock,

- (iii) nominal value per share of each class of stock

- Select a registered agent, file an application for registration, and register the company

- After company registration, obtain a mailing address in the US to receive an EIN and apply for an EIN

Post-Incorporation:

- After obtaining the EIN, open a bank account

- Conduct an initial equity distribution among the founders and sign IP Assignment Agreements with the founders

- Finalize and sign agreements with the team (NDAs, Service or Employment Agreements, and IP Assignment Agreements)

- Approve the stock option plan and sign option agreements with the team (optional)

Part 1: Incorporation in Delaware

If you have chosen Delaware as the jurisdiction in which you want to register, let’s run through the basics of C corporation registration. There are several steps within this section, all with various tasks and requirements to be satisfied before progressing further.

👉 Register a company in Delaware now

What is a cap table and why do you need one?

Before registering your C corporation, you and your founders will have to prepare a Capitalization Table, frequently called a “cap table” or a "captable". This is a document that will include information on:

- Who will be the shareholders of the company

- What class of stock each shareholder will have

- How many shares will be issued to each shareholder

- What percentage of ownership each shareholder will have

- How many shares will be reserved for the option pool, if any (optional).

In most cases, at the early stages of startup development, only shares of common stock are authorized and issued. However, if you have multiple classes of shares, this should also be reflected in the cap table.

The cap table is strictly an internal document and does not need to be submitted anywhere or made public. Starting the company registration process without gathering and preparing the aforementioned information for the cap table is not recommended. This is because if you and your co-founders have potential ownership disputes after the company is registered, this can cause issues related to equity distribution and the company’s corporate governance!

What does a typical company's cap table look like?

Your cap table will typically look like this:

How to prepare your cap table

It’s quite common for founders to have some sort of loose agreement about ownership between themselves at an early stage of starting their business. However, having a cap table to set everything out and also detail the size of the option pool is really important. If you haven’t created a cap table yet, you can have a go at doing one yourself, however, it’s best to have some help with this, to make sure that your cap table is correctly prepared and accurate. A professional can also guide you through the different classes of shares and answer any questions you may have. For help building or polishing your cap table, speak to Legal Nodes today.

List of initial directors of the newly created company

To register a corporation in Delaware, you first need to answer a list of specific, yet customized, questions. The list of questions you must answer depends entirely on which registered agent you choose to use (more on that later). In addition to the standard list of contact information that needs to be provided to the agent, it is important to determine the following before registering the company:

In most countries (the UK included) shares of the company are allocated among the initial shareholders at the time of registration. However, in Delaware, when the C corporation is created, there won’t be any shareholders. Instead, shares will need to be distributed among the founders after the creation of the company in the post-incorporation stage. That is why the initial directors (the individuals designated as directors of the company at the time of its creation) will manage the company and deal with the subsequent distribution of shares among the shareholders.

It is common practice to appoint several founders as initial directors (for example, in a company with three founders, all of them can be appointed as initial directors). Although there can be any number of initial directors, it is not recommended to appoint more than 3 or 4 directors, as this can create complexities in corporate governance.

Number, price, and classes of shares of the future company

Although there are no restrictions or general rules regarding the nominal price and number of shares in a company, the best practice for startups is to authorize 10,000,000 shares of common stock at a price of $0.00001 per share.

Please note that the nominal price of shares does not affect the valuation of your company in the future, but only determines the minimum price at which a share can be sold. The low nominal price of shares at the time of company creation is set to simplify the initial distribution of shares to the founders of the company.

Regarding the classes of shares, although it is possible to authorize both common stock and preferred stock classes of shares when registering a company, in most cases at the early stages of startup development, preferred stock classes are not authorized or used.

Registration address and business address of your company

All companies in Delaware are automatically assigned a registered (legal) address. The registered address is provided by the registered agent and it will be displayed in public registries. If you have a physical address in Delaware, then you may act as your own company’s registered agent. Further down the line, you will need a business address to obtain a tax identification number (EIN), which will be used for correspondence from US government agencies.

The business address can be:

- The address of your actual office in the US

- Your current local address

- A rented mailbox in Delaware

Since most early-stage startups will not have a physical presence in the US, important letters may get lost on their way to a founder’s country of residence or other foreign address. To prevent any mail from becoming lost, we recommend renting a mailbox in the US and using its address as the business address for all official documents (for example, when applying for an EIN, which we will cover further on).

Get help setting up your C Corp in Delaware

Legal Nodes supports founders wishing to set up a C corporation in Delaware by exploring different business address options and explaining more about matters pertaining to company shares. For assistance with setting up a startup in Delaware, speak to us today.

Choosing a corporate agent and filling out the company registration application

Every company in the state of Delaware must be registered through one of the accredited corporate or registered agents. There are several popular agents to choose from, and if you’re concerned about which one you should choose, we can help. In reality, the choice of agent is only important at the initial stage of company creation and has little impact on its further operations. Agents mainly differ in registration fees and annual company maintenance fees (which must be paid every year), as well as the functionality of their interface and the additional services they provide.

Be aware that not all registered agents assist with post-incorporation matters, which means that in this case, all documents regarding the distribution of shares among founders will need to be prepared by the founders themselves. Don’t worry, we help by providing templates for these documents and instructions on how to complete them. All of this is available through our subscriptions.

Regardless of which corporate agent you choose, typically, after submitting the online application through a corporate agent, your company will be created within 7 business days.

Obtaining an EIN (Employer Identification Number)

Every legal entity must obtain a federal tax identification number before it can open a bank account in the US, hire American employees, or pay taxes. The Employer Identification Number, sometimes called the or the Federal Tax Identification Number, or EIN, is a unique nine-digit number, one without which a company cannot properly start its operations.

You can apply for EIN online or through an agent that handles the incorporation of your company. To obtain an EIN, you need to provide your business address. If you do not have a physical presence in the US, we recommend following these steps:

- Order company registration through an online agent without the EIN service.

- After company registration, utilize the services of a mailbox rental and purchase a mailing address in the US. You can obtain a US address here.

- After receiving the address, request the agent to obtain an EIN, providing your mailbox address as the business address in the EIN application.

It’s important to note that some agents offer mailbox rental options during the company registration process. If this is the case with your agent, you can order your EIN immediately.

Typically, obtaining an EIN takes approximately up to 3 weeks. After obtaining an EIN, you will be able to open a bank account and transfer or receive funds via wire transfers.

Opening a bank account

If you are setting up your company in Delaware, one of the many advantages is that you can open a bank account online relatively easily. The most popular options are:

If you have any questions about obtaining your EIN or setting up bank accounts, Legal Nodes can help. Founders sometimes ask if registering a company and opening an account will be enough for them to start receiving payments from clients into company accounts. We help provide those answers on a case-by-case basis. Get started with Legal Nodes here.

Founder FAQs about Delaware C corporation registration

This section comprises important information for founders and clarification on issues that will need to be addressed and understood at this part of the registration journey. This includes matters on authorized and unauthorized shares, share issuance, post-registration documentation, and how to source information on registered C corporations.

What is the difference between authorized and issued shares?

As most countries follow the practice of allocating company shares among the initial shareholders upon registration, in Delaware they handle this a little differently and it’s important to understand how this affects things. A C corporation incorporated in Delaware will not have shareholders at the time of creation. After the company is formed, shares will need to be distributed among the founders. This takes place during the post-incorporation stage.

However, before incorporation you must determine the initial number of shares the company will have. This number represents the maximum number of shares that the company can issue and these are deemed the authorized shares. Issued shares are the shares that the company has actually issued to its shareholders. The number of issued shares cannot exceed the number of authorized shares.

The number of authorized shares can always be found in the Certificate of Incorporation. Usually, it is displayed as follows:

Should all shares be issued at once?

Thanks to the flexibility of US legislation, a C corporation may choose not to issue all of its shares immediately after formation. For example, founders may allocate 80% of the shares upfront, reserve 10% for an option pool, and leave 10% unallocated.

In the future, the unallocated shares can be distributed among founders, sold to an investor, given to an advisor, or remain unallocated (at the discretion of the company).

It is worth noting that only issued shares are used for capitalization purposes.

Deciding how many shares to issue largely depends on the specific plans of each business.

How to increase the number of authorized shares?

The number of authorized shares in a company can always be increased by amending a Certificate of Incorporation of the company. For example, if a company is preparing for a new investment round under which shares are to be issued right away, this is an ideal opportunity to increase the number of authorized shares. To do this, changes must be made to the Certificate of Incorporation.

Take the following required steps to make changes to the Certificate of Incorporation:

- Hold a meeting of the company's shareholders and/or board of directors and obtain their approval to amend the number of the company’s authorized shares. Before the meeting, founders should check the bylaws and Shareholders Agreement for any additional requirements that might apply to the procedure pertaining to the change of the company’s authorized capital.

- Prepare an updated version of the Certificate of Incorporation and submit it for review to your corporate agent. In the updated certificate, indicate the new number of authorized shares, their par value, and/or classes of shares. Your agent will then submit the updated certificate for state registration.

Usually, the registration of a new certificate takes up to 3 weeks.

Documents you will receive after your company is registered

- Stamped and certified Certificate of Incorporation, which is issued by the registrar confirming that the company has been successfully registered.

- Bylaws. These are the company's statutes. Essentially, these are a set of rules that govern the company's operations and internal management of the company.

Certificate of Incorporation

Your Certificate of Incorporation is a document that is filed for the incorporation of your company, that also contains its initial basic set of rules. It must be filed with the Secretary of State of Delaware. This is the document that creates and authorizes each class of shares and any series of stock as your company begins to raise money. The Certificate of Incorporation is also important as it establishes the basics of your company. It covers corporate governance matters as determined by Delaware law and sets out statutory requirements, with details of the company’s name, registered office in Delaware and business purpose.

If you are registering the company online, the Certificate of Incorporation and Bylaws will be sent to your email address in digital format (PDF). Since these are the essential founding documents of your company, there are many scenarios where you may need them, for example, when opening a bank account or during due diligence processes prior to selling shares to new investors.

Do not lose these documents! Take proactive steps to securely store them in a virtual Data Room belonging to your company (e.g., Google Drive) and ensure they are always accessible for business use.

Minute Book

Another important task in the post-corporation period is the creation of a minute book. This book will hold records of any meetings with the board and with your shareholders. It is required by law to keep an up-to-date minute book. You won’t need to file these records with the state, but should you enter into any litigation over the status of your corporation, this is where having a minute book becomes a legal requirement.

Where to check information about registered C corporations

Before you attempt registration, you’ll need to check the Delaware registry. This is because the name of your future corporation should not match the name of any other company created and registered in the state of Delaware. Therefore, before starting the incorporation process and after you have decided on the name of your company, you should independently perform a free name check using the Delaware registry to ensure that it is available.

Once you’ve completed registration, it’s always a good idea to check everything has gone through properly and you are listed correctly. You can check information about registered C corps in Delaware here.

How to use the Delaware Entity Search (Delaware C Corporation registry):

- Go to the registry Delaware Entity Search website. If the page does not open you may need to use a VPN.

- Enter the full name of the legal entity (Entity Name) or the company's number (File Number) in one of the fields.

- Use the Search button to generate results. They will appear once you’ve started the search. Click on a company name to view the company details.

Please note that sometimes, after selecting the desired company, the information in the registry does not load, and the fields with entered information are cleared. In this case, you need to repeat the procedure again, and after the second or third attempt, the information will appear in the registry.

Launch a startup in Delaware with help from Legal Nodes

Figuring out which country to choose for registering your company can be complicated! Learn more about general startup legal structuring in this guide and read more about how to choose a country of residence as a digital nomad entrepreneur.

Part 2: Post-incorporation information for founders

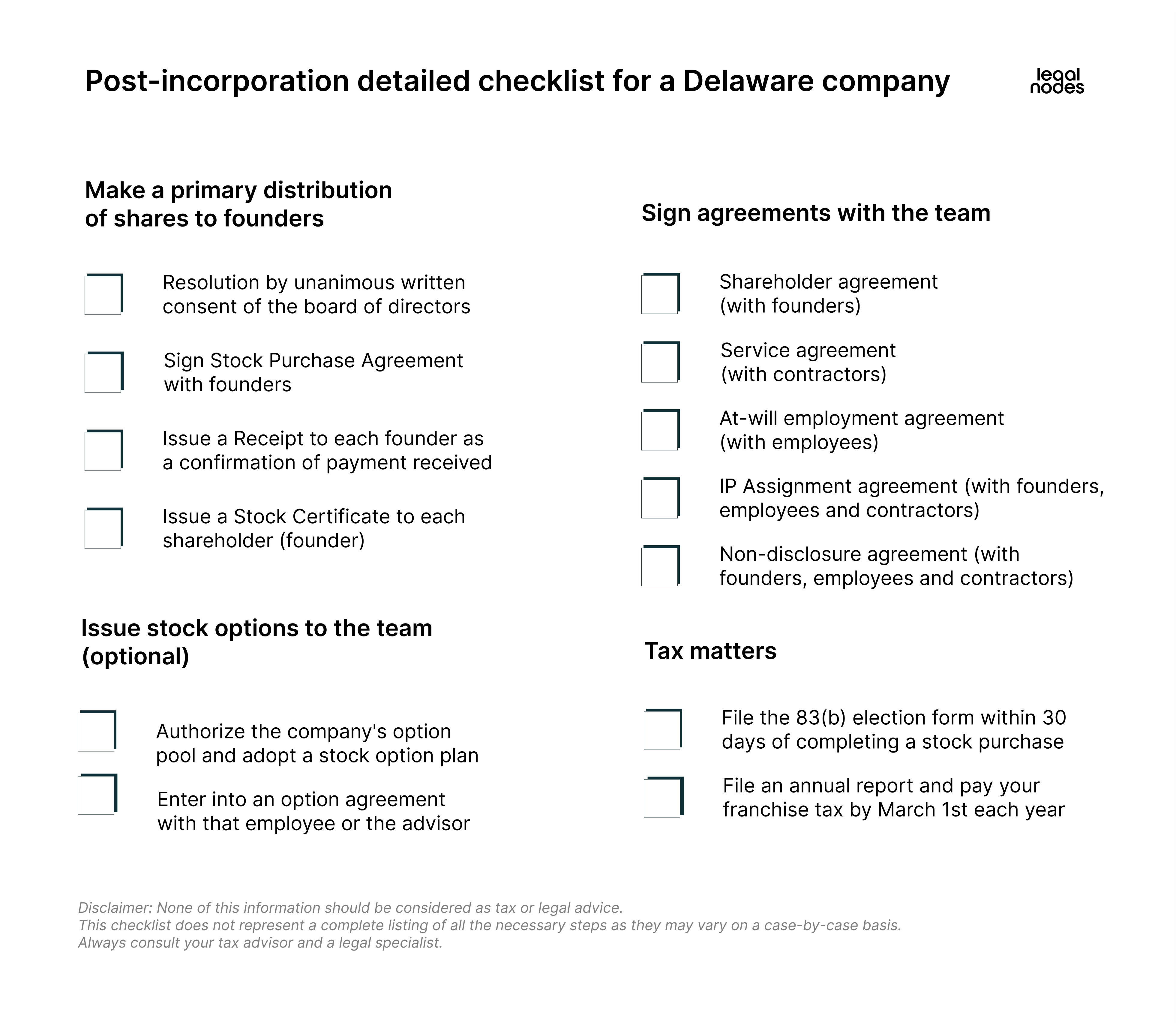

Now that you’ve incorporated your business and registered it in Delaware, there are a few more things to take care of, including the primary distribution of shares to founders and commercial documentation for your startup.

The primary distribution of shares to founders

As mentioned before, at the time of creation, a C corporation will not have shareholders. Shares will need to be distributed among the founders after the company is formed, during the post-incorporation stage. Issuing shares to founders is a necessary procedure that is carried out after the company has been registered. Shares are issued within the maximum amount of the authorized capital specified in the company's Certificate of Incorporation.

It is prohibited to issue more shares than specified in the Certificate of Incorporation, but issuing fewer shares is allowed. Therefore, it is very important to create a cap table before issuing shares to founders in order to avoid mistakes.

What does the process of share distribution look like?

First, to carry out the primary distribution of shares in the company, the board of directors passes the resolution by unanimous written consent of the board of directors, which specifies who receives shares and in what quantity. This document is an internal document of the company and should not be filed anywhere.

Next, based on the action by unanimous written consent of the board of directors, each founder enters into a Stock Purchase Agreement with the company, which specifies the number of shares the founder is purchasing from the company along with the price (usually, the sale is made at the nominal price).

Then, the company issues a Receipt to each founder as a confirmation of payment received from the founder for the purchased shares.

Finally, the company issues a Stock Certificate to each shareholder, which confirms that the founder has acquired a certain number of shares. The Stock Certificate is the main document for the founder, certifying the number of shares owned.

Some registered agents will provide templates for these documents, meaning you won’t have to prepare anything yourself. If you’ve opted for a registered agent that does not provide templates, or if you wish to get additional support with any other aspect of this process, Legal Nodes can help. Speak to us to get a clear understanding of your obligations and the legal steps you need to take to successfully incorporate, register, and issue shares for your company.

What tax considerations should founders be aware of?

This guide does not cover tax matters to a great extent, however, there are a few things that we wish to highlight.

Once you have incorporated your company, you will be obligated to file company tax reports annually. You must file an annual report and pay your franchise tax by March 1st each year. To calculate the amount of Franchise tax to be paid please refer to the Delaware Franchise Tax Calculator.

If you have chosen to have shares subject to the reverse vesting mechanism, it will need to be reported to the United States Inland Revenue Service (IRS) under 83(b) election if you are a US taxpayer, or non-US taxpayer that plans to move to the US. This is stipulated under Section 83(b) of the Inland Revenue Code, and 83(b) election allows founders to pay tax on their shares immediately. Founders do not have to wait until all shares vest, and consequently, this usually leads to founders paying much smaller tax amounts. It is critical that the 83(b) election form is filed within 30 days of completing a stock purchase.

To help founders identify tax obligations, Legal Nodes works with qualified tax professionals situated in jurisdictions worldwide. We support founders by connecting them with relevant tax experts who guide them through tax processes and requirements. Learn more about how to choose a tax-friendly jurisdiction for registering a company here.

Other Documentation for Delaware-registered startups

The following is a list of documents that may be needed after incorporation in Delaware.

Shareholder Agreement

Shareholder agreements define the rights and obligations of shareholders of the company, as well as the corporate governance of the company (e.g. voting process, sale of shares or their issuance by the company, etc.).

Service Agreement

This is a template of a contract that can be signed with individual contractors who will provide services to the company.

Don't forget to include in the document:

- Services provided

- Remuneration received by the individual entrepreneur/person. For individual entrepreneurs, only monetary remuneration can be provided. It can be either a fixed monthly rate or hourly payment.

At-will Employment Agreement

This agreement will stipulate the terms of employment of your employee, including the employee’s salary, benefits, and job duties. Importantly, the agreement will include a section on termination rights for both the employee and the employer. Under the rules of the “at-will” agreement, either party can terminate the agreement by the terminating party simply notifying the other party and giving the agreed period of notice.

Non-Disclosure Agreement

This is an agreement that will establish the obligation of your employee/contractor to keep the company's confidential information confidential.

IP Assignment Agreement (usually in a form of PIIA)

The Proprietary Information and Inventions Agreement (PIIA) is a document by which the founders, employees or contractors transfer the intellectual property rights to any developments related to the product that is created for the company, or developments made prior to the incorporation of the company, to the ownership of the company. This document is often required by investors as it is a crucial document that transfers the rights of intellectual property (IP) developed by either the founder,employee or a contractor to the company.

It is important to ensure that the company has full ownership of all IP, especially IP created by employees. Without this ownership, potential investors and buyers may be concerned that the employees with the IP ownership could leave and take their IP with them. This makes the company a lot less attractive and a lot less valuable. Founders should always sign these agreements and make sure that they are a requirement for all future employees.

Templates for all the documents outlined above are available through Legal Nodes with a subscription to either our Growth or Maintenance Plan. Discover more about our plans here. We’ll help you figure out which document you need, and whether you need to sign NDAs with all your contractors. We also help you complete these templates and ensure that everything is accurate and written to protect your founders and company.

Beneficial Ownership Information (BOI) report

Beginning January 1, 2024, the Corporate Transparency Act (CTA) requires that most US legal entities file a Beneficial Ownership Information report with the U.S. Financial Crimes Enforcement Network.

If your Delaware C-corp was established before January 1, 2024, you must file a BOI report by January 1, 2025. Entities formed on or after January 1, 2024, need to file a BOI report within 90 calendar days of their formation or registration.

Failure to comply could lead to severe consequences, including criminal charges and fines of up to $500 a day.

🔍 Get help with your BOI report

Option agreements with employees and advisors (US)

At the post-incorporation stage, you can also create an option pool and enter into option agreements with your employees or advisors. This section explores what option pools are and if they’re necessary.

What is an option pool?

An option pool consists of shares that are reserved for the startup's employees or advisors. An option pool can be created at any time from non-issued shares of authorized capital of the company. However, we recommend determining the initial size of the option pool when creating the cap table.

To grant a specific employee an option from the company's option plan, you need to:

- Authorize the company's option pool and adopt a stock option plan

- Enter into an option agreement with that employee or the advisor

An option agreement is an agreement in which an employee or the advisor is granted the right to purchase company shares at a pre-agreed price after fulfilling certain KPIs or working with the company for a certain period of time (also referred to as the vesting schedule). It is expected that under such conditions, the employee or the advisor will make maximum efforts to increase the company's value, as the value of their option will also increase.

Why is an option pool necessary?

Option pools can help you attract both employees and advisors, as well as investors. By offering employees or advisors a share of the company, you incentivize them to act as owners and do everything possible to help the company grow, so that they can eventually share in its success. Potential investors also expect that with the help of an option pool, your company will be able to attract and retain the best employees and continue scaling.

Ultimately, once they have a financial stake in your company, they want your business to be successful as much as you do.

What key terms are included in option agreements?

Exercise price: The price an employee pays to acquire company shares (usually it’s a nominal price per share on the company incorporation stage or FMV (fair market value) further on).

Vesting schedule: The schedule that determines when an employee can exercise their option. Most startups have a four-year vesting schedule with a one or two-year cliff (though it's worth noting that you're free to set any vesting schedule). The cliff is the minimum period the option holder must work for your company to receive the first portion of their option.

For example, in a four-year option with a two-year cliff and an annual vesting schedule (where the person would receive 25% of their option annually), the employee must work a minimum of 2 years to receive the first 50%. Otherwise, even if they are terminated after 1 year and 10 months, they will receive nothing. After the cliff, the rights to the remaining option gradually vest over the remaining years until the option is fully vested.

It’s important to note that achieving KPIs may also be implemented as part of the vesting schedule.

Issue date: The date the options are granted.

Exercise date: The date by which an employee can exercise their options.

Expiration date: The date after which an employee can no longer exercise their options.

“Good leaver” / ”Bad leaver”: These are different scenarios provided for in the option agreements when a person ceases to be an employee of the company. A good leaver usually means the termination of employment with the company acceptable to the company, such as retirement, disability, occurrence of a certain event, etc.. If a person is recognized as a good leaver, they retain the right to the option shares that have already vested.

In contrast, a bad leaver usually refers to the justified dismissal of an employee on grounds that have caused harm to the business and where evidence of such harm is already evident. The concept of a bad leaver may be associated with factors such as employee fraud or breach of contract with the company (including NDA provisions). If an employee is considered a bad leaver, they lose their rights even to the shares that have already vested.

Tools for managing option programs

The most popular tools for setting up an option plan and generating option agreements for your delivery company online are:

It’s important to pin down the answers to some questions surrounding your option pool. These include figuring out the best amount of shares to reserve for the option pool in light of your business goals. It’s also important to ensure that the option agreements have been drafted correctly and are signed at an appropriate point in the post-incorporation period.

Creating a stock option plan

Stock option plans can be a great tool for motivating and incentivizing employees to contribute to a business in exchange for stock options. We’ve explored the employee stock option plan (ESOP) in more detail here and have also created a pocket guide covering all the key terms and aspects of ESOPs.

Setting up option plans has lots of different steps, like securing stockholder consent. To form a stock plan, stockholders need to approve the plan and they do this via providing stockholder consent. We help founders set up these plans, from the key terms to the option agreement templates, and navigate things like stockholder consent, so that founders can quickly and effectively secure team members and consultants early on in their business journey.

Incorporate and register your startup in Delaware with help from Legal Nodes

Legal Nodes helps founders who have global businesses and global legal needs. We support founders with everything from assessing different legal options to establishing entities and maintaining them as the business grows. If you are considering Delaware as a jurisdiction for incorporating and registering your startup, we can help by:

- Providing a global perspective on legal options, including verifying or challenging the notion that Delaware might be best for your needs, and providing alternative jurisdictions that may be more suitable.

- Registering an operational company in Delaware and providing you with ongoing privacy and regulatory support to enable you to enter the EU market in a compliant and risk-free manner.

- Supporting you through the journey of company registration and post-incorporation, ensuring that nothing falls through the cracks and everything is completed as quickly as possible. We assist with the preparation of documentation and handle communications with the registered agent. We also connect founders with other specialists, such as the CPA if required and help with other processes, such as setting up accounting.

If you’re ready to incorporate and need legal support, speak with Legal Nodes today.